As the VP of Investments at a fintech company, it’s my job to pay close attention to the ever-changing trends and progress within the world of money. Working at Fundrise also means I’m directly involved with the development of the real estate investing industry — one of the financial sectors that was most in need of innovation — and has let me watch some of the important advancements in real estate investing. Specifically, I’m thinking of the ways many savvy investors have started to use real estate — a classically alternative asset class — as a core component of their investment portfolios.

And I’m happy to say I have good news: As modern solutions have made real estate less an alternative investment and more of a go-to for investors, it’s emphatically proven itself as an opportunity-rich investment class, with potential advantages and substantial benefits for portfolios of nearly every type.

What kinds of advantages and benefits? Think reliable cash flow, historically powerful diversification, potential for long-term growth — just to name a few.

There’s even better news, too: Today, investors have a wealth of sophisticated, varied ways to become real estate investors. That even includes one option — Fundrise — that has integrated private market real estate’s traditional benefits with cutting-edge tech solutions, endowing those investments with the kind of transparency, user-first efficiency, and intuitive experience that today’s investors have come to prioritize in their most advanced financial systems.

So, with that in mind, let’s start by taking a closer look at a few of the big reasons why many investors choose real estate, and then cover the options available to today’s investors for adding real estate to their portfolios.

Reducing Volatility

There’s no such thing as an investment that doesn’t experience changes in prices— every asset class moves up and down, given enough time. The stock market rises, and, eventually, inevitably, the stock market falls. The classic wisdom is to wait long enough to see the balance settle into the black.

However, some types of investments are indisputably less volatile than others — and investors who choose real estate often do so with the understanding that it can add overall stability to their portfolio.

The nature of real estate — its direct, tangible use — makes some investments with the asset class more resilient against the winds of change, which can occasionally blow stock trading floors into a dizzy tumult. Real estate’s value is obvious, but powerfully persistent: after all, people always need places to live, companies need office space, and retail shops need storefronts out of which to run their businesses. Sound private real estate has solid value in any market. Any changes in real estate prices will often be substantially different from changes in the public market — and often to lesser extremes — so as to provide a stabilizing ballast to the rest of a portfolio.

If an investor exposes themself to different volatility waves, then there’s a greater chance that their portfolio’s overall performance will be able to resist any single downturn; that’s one of the fundamental ideas of diversification. A rule of thumb I’ve often seen is that institutional investors aim to allocate 10-20% of their portfolios to real estate for this very reason. Diversification is an investing fundamental that all investors stand to benefit from, as it both mitigates losses and has historically led to higher returns overall.

Supplemental income streams

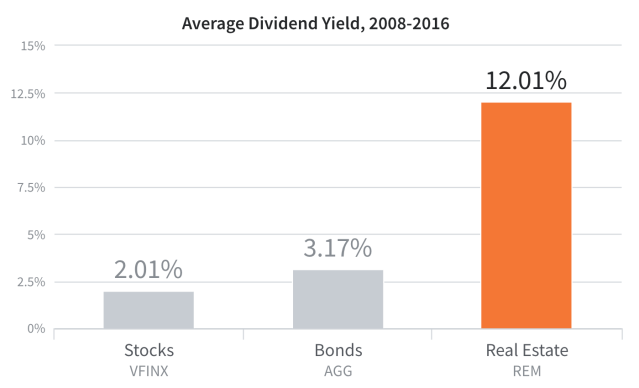

As I wrote in a Mint blog post last year, investing in real estate is one of the easiest ways to earn supplemental income. As an asset class, real estate is a naturally optimal way to establish an independent cash flow: for some types of real estate investments, a significant portion of returns comes as a direct result of properties collecting rent payments. For investors, that often means reliable, substantial dividend streams.

The information presented above represents the average annual dividend yield for the Vanguard 500 Index Fund (VFINX), the iShares Core Aggregate Bond ETF (AGG), and the iShares Mortgage Real Estate Capped ETF (REM), from 2008 to 2016. Source: Yahoo Finance Historical Prices.

Why does that matter? Some studies have shown a compelling correlation between individuals with multiple income streams and their eventually becoming self-made millionaires. The more you can liberate yourself from any single source of income, the more flexibility you have with your finances — and the less exposed you are to risk of ruin.

There’s also the inherent advantage of collecting more of your returns on an ongoing basis, over the lifetime of your investment. The majority of stock market investments only pay meaningful returns at their conclusion, as capital gains, when an investor sells their position in the securities.

Real estate frequently pays a substantial portion of its potential returns in regular installments — which means you, the investor, have the opportunity to benefit from that money, in-hand, however you see fit. That might mean continuing to grow your finances elsewhere, or reinvesting directly back into the real estate and compounding your investment’s performance over the long term.

Protection against inflation

Also as a result of real estate’s ability to generate income on an ongoing basis, a sound real estate investment can serve as a powerful hedge against inflation. Real estate’s potential cash flow means that returns are able to scale up along with the inflation of the economy within the economy around it. As costs of living increase, rent can follow suit, and that means dividend payments represent returns that can match general economic trends.

This capability is, again, tied closely to real estate’s role as a hard asset. It provides and harvests intrinsic value that can often withstand market turmoil, simply through its obvious uses: as residences, places of work, manufacturing centers, etc. It has an indispensable and considerable role in the society where it exists. That means its owners automatically benefit, financially, when people necessarily pay to use it.

But there’s another, even more obvious reason too: real estate benefits from natural scarcity. There is only so much land in a given area. As cities grow, demand for real estate increases, the supply of which is naturally constrained by geography. You’ve probably heard the apocryphal quote, often attributed to the man of seemingly infinite quips, Mark Twain: “Buy real estate — they’re not making it anymore.” With scarcity, of course, comes natural appreciation.

And investors who own stakes in that real estate can see their returns ladder up proportionally, on a regular basis, holding a buffer against inflation that some traditional investment assets simply do not.

100vw, 640px”><figcaption id=) The information above represents the growth in percentage of the Median Sales Price for New Houses Sold in the United States and the Consumer Price Index: All Items for the United States from 1965 to 2016. Source: Federal Reserve Bank of St. Louis Economic Data.

The information above represents the growth in percentage of the Median Sales Price for New Houses Sold in the United States and the Consumer Price Index: All Items for the United States from 1965 to 2016. Source: Federal Reserve Bank of St. Louis Economic Data.Some real estate has serious tax advantages

A discussion of real estate’s upsides would be incomplete without a mention of the numerous potential tax benefits available to investors. Of course, whether or not an investor qualifies for real estate’s tax benefits depends completely on their specific financial situation — and the exact method they use to invest — but I’ve seen real estate’s tax treatment become a deciding factor in many people’s choice to invest.

For example, the 1031 Exchange is a rule potentially benefiting those investors who choose to access real estate properties through direct purchase. These exchanges allow investors to defer paying capital gains tax on the sale of a property by reinvesting proceeds into a new property. Essentially, a 1031 Exchange allows an investor to preserve the gross equity earned from a real estate investment, increasing their buying power on their next investment. It suits investors who like to play a more active role in their real estate acquisitions and anticipate keeping their investment in the industry over the course of multiple deals.

Meanwhile, last year’s new federal tax law introduced a tax break for those who invest through REITs and receive income as a result. Related to the fact that REITs are structured as pass-through entities, REIT investors now have the opportunity to claim up to a 20% deduction on income generated through those investments. While there are restrictions and variations on how that deduction is applied, it means that many REIT investors can now anticipate a built-in tax break as part of their investment. Additionally, this is one tax benefit with direct application for our investors at Fundrise. Read more about that here.

As a final example, the new tax law also introduced the Opportunity Zone program, which has truly profound tax potential. This program encourages private investments into low-income communities across the US by offering capital gains tax incentives to Opportunity Zone investors. The Opportunity Zone program comprises a combination of Opportunity Zones (the investment opportunity) and Opportunity Funds (the investment vehicle). In exchange for investing in Opportunity Zones through Opportunity Funds, investors can receive new, substantial capital gains tax incentives, including tax deferral and reduction options on the principal invested as well as the potential to eliminate taxes on any capital gains subsequently earned from Opportunity Fund investments.

Again, this is only a brief and simplified glance at real estate’s potential tax benefits, but a primary takeaway should be that the potential advantages are substantial and available to real estate investors of many types: those new to real estate, those long familiar with it, active investors, passive investors, and more.

From “why” to “how”

Remember: each of the points discussed above represents a benefit of real estate investing with potential value for all investors, not just those with past real estate experience. Every investing portfolio can be made stronger by adding new income streams, hedges against inflation, and private market interests. You don’t have to be a certain kind of investor to demand those advantages — you just have to know where to ask.

Which brings us to a quick list of a few ways you can invest in real estate:

Buy a property directly. This is the kind of real estate investment you might be familiar with thanks to popular TV shows on HGTV — think fix and flips. You’ve also more than likely been on the paying end of a renter-rentee situation; just imagine being the landlord and collecting rent payments every month.

The big challenges here involve the substantial amount of capital it can take to purchase a property and, if you plan to own it for an extended amount of time, such as is necessary with a rental property, the amount of work and upkeep that kind of investment requires.

Buy shares of a REIT. A REIT — or real estate investment trust — is somewhat like a mutual fund for stocks. A REIT is a fund that can own many separate pieces of real estate; when you invest in a REIT you buy shares of the overall fund, which gives you exposure to a broad range of individual properties. Unlike buying a property directly, you don’t need a major chunk of cash to get started with a REIT — just enough to buy your preferred number of shares.

However, not all REITs are created equal. Some of the most familiar are structured to be traded on public markets… and that means they sacrifice a lot of the value that private market real estate can offer. Depending on how you invest in a REIT, you might also find yourself paying account management and brokerage fees, which can reduce your total possible returns.

Invest with Fundrise. Fundrise provides investors of all levels direct access to private market real estate, with all of the convenience and affordability or typical non-traded REITs, along with an online investment platform that uses a suite of cutting-edge solutions to provide extreme transparency, constant insights into investment performance, and bare-minimum account fees.

On top of those benefits, Fundrise real estate represents true private market investments — premium properties that are available through Fundrise and nowhere else, fulfilling a broad spectrum of investment types, with a diverse range of size, type, and location.

Whatever your experience with real estate, or investing in general, always keep this in mind: just because certain opportunities weren’t available to many investors in the past doesn’t mean you should ignore them now.

We’re living in a revolutionary time for personal finance, where new innovations in technology, business solutions, and the exchange of information mean it’s possible for every investor to put together a sophisticated, mature portfolio. Finance is undergoing a constant stream of innovation and exciting developments. But even as investing changes and becomes more user-friendly year after year, real estate remains an indispensable investment option for building wealth, just as it’s been for thousands of years… and as I suspect it’ll continue to be for many, many years to come.

Kendall Davis leads the Investments Team at Fundrise, the first investment platform to create a simple, low-cost way for anyone to unlock real estate’s historically consistent and exceptional returns. Since joining in 2014, Kendall has built out investor relations for the company, focusing on all aspects of the Fundrise investor experience and furthering the company’s mission to democratize real estate investing. Stay up to date with the latest from Fundrise through their social channels: Facebook, Twitter and LinkedIn.